The global economy runs on efficient cross-border account-to-account (A2A) payments, and yet the average global straight-through processing (STP) rate is as little as 26% according to LexisNexis® Risk Solutions recent study into the True Impact of Failed Payments.

Deteriorating macroeconomic conditions and rising inflation pressures leave little room for payments failures, costly errors and operational delays. Failed payments are eroding profitability and impacting performance in a climate where businesses need their money to work harder than ever.

Payments Fuel the Global Economy

The rapid expansion of digitally connected commerce has propelled payments from being the endpoint of a transaction to playing an essential role in global supply chain efficiency and end-to-end customer ecosystems.

Global commerce is in constant motion. The effectiveness of the payment flows moving the global economy forward depends heavily on the efficacy of cross-border agreements, the reliability of counterparty relationships and the accuracy of the global payments data underpinning every transaction.

The Direct and Indirect Costs of Failed Payments Impact Sustainable Success

Suppliers and consumers expect universally consistent, reliably secure and fast payments experiences over every channel and modality.

The ability to deliver seamless straight-through processing and responsive security across the payments spectrum is a critical competitive differentiator in today’s crowded marketplace. Businesses failing to perfect that balance face the detrimental impacts of repair fees, supply chain disruption, productivity losses and customer attrition.

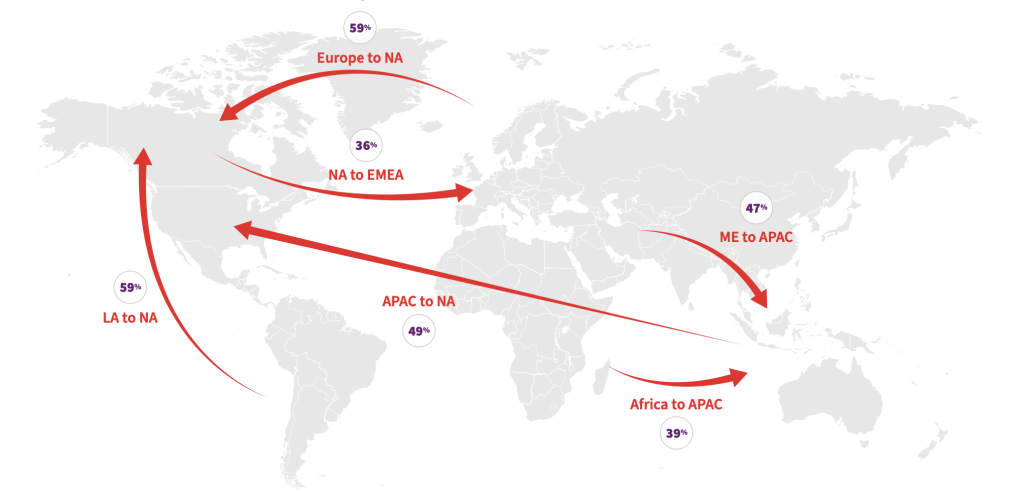

Vulnerable Routes for Cross-Border Payments

Cross-border payment routes with highest failed payments, shown by percentage of companies impacted

A global average of 14% of cross-border payments are not completed and incur charges from a banking partner. This LexisNexis study finds no big differences per region, or banks vs. corporates, because large banks and corporates included in their survey operate globally. It has also been cited that the main source of failure comes from bank beneficiary name and address details, manually checked by 72% of their respondents. This is followed by issues connected to account numbers (IBAN and non IBAN).

Companies estimating a high percentage of customers lost due to failed or delayed payments have a higher STP rate on average. This shows that customers benefitting from high level of STP payments and automation are very sensitive to failed and delayed payments.

Largest (10k+ employees) and mid-sized (250 – 1,000 employees) companies seem to lose a higher percent of customers than small companies.

“Failures add up to millions in costs to our business, even at a low volume of failed payments. Payments failing due to currency issues and missing validation of instruction has direct cost impacts and indirect cost impacts on productivity and customer experience.” – Product Manager Cross-Border Payments, Multinational U.S. Financial Institution

Universal cost and operational impacts of failed payments

Today’s global economy makes it critical for the payments function to contribute greater strategic value by helping the enterprise extend capital efficiency and better leverage liquidity. This report from LexisNexis illustrates how fast payments solutions, such as payment processing APIs, are enabling payments teams to realise higher STP rates, facilitate frictionless payments and achieve measurable performance gains. Today’s dynamic payments climate demands a level of speed, accuracy, and safety that prioritises customer and supplier experience at every touchpoint. Ultimately, prioritising the customer and supplier experience throughout the payment process is crucial for building trust and fostering long-term relationships. By embracing automation and utilising payments data, businesses can deliver seamless and reliable payment experiences, ultimately driving growth and success in today’s fast-paced global economy.

This article/report was first published by LexisNexis Risk Solutions and has been republished on our website with permission.